Samsung plans to start making HBM3E memory chips next month but still needs NVIDIA's approval. The Korean company must win this contract to catch up with competitors in high-bandwidth memory tech. With recent positive comments from Jensen Huang about their progress, Samsung feels confident about securing a deal soon.

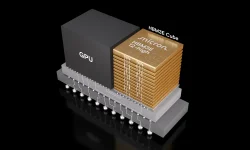

Micron has already started mass-producing 12-layer HBM3E chips—more advanced than Samsung's 8-layer solution. These memory chips will reportedly power NVIDIA's upcoming "Blackwell Ultra" B300 AI servers. Micron has completely sold out its production capacity for these chips. The company aggressively expands manufacturing lines because it wants to take market share from current leader SK Hynix.

Trump's trade wars created supply chain worries, pushing companies like NVIDIA to place massive orders early before new tariffs hit. NVIDIA also wants multiple suppliers rather than depending just on SK Hynix. The high-bandwidth memory market keeps growing as AI demand increases. With next-generation HBM4 technology coming, both Micron and SK Hynix have great chances to profit even more from this booming market.

Micron has already started mass-producing 12-layer HBM3E chips—more advanced than Samsung's 8-layer solution. These memory chips will reportedly power NVIDIA's upcoming "Blackwell Ultra" B300 AI servers. Micron has completely sold out its production capacity for these chips. The company aggressively expands manufacturing lines because it wants to take market share from current leader SK Hynix.

Trump's trade wars created supply chain worries, pushing companies like NVIDIA to place massive orders early before new tariffs hit. NVIDIA also wants multiple suppliers rather than depending just on SK Hynix. The high-bandwidth memory market keeps growing as AI demand increases. With next-generation HBM4 technology coming, both Micron and SK Hynix have great chances to profit even more from this booming market.