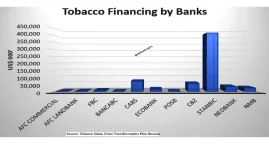

Banks poured over 600 million US dollars into Zimbabwe's tobacco sector for the 2024/25 season. Stanbic Bank led the pack with a massive 415 million dollar contribution. Other major banks like CABS and CBZ also chipped in significant amounts to support farmers growing the country's second-largest export crop.

Most tobacco funding happens through merchants who take big risks lending to farmers. Banks hesitate to loan money directly because farmers lack traditional collateral. Merchants step up as middlemen, providing seeds, fertilizer, and chemical supplies to growers through complex contracting systems.

Analysts suspect some local bank funding might actually come from international sources. Foreign-owned banks like Stanbic and CABS seem to channel money from parent companies overseas. These arrangements make the funding look local but potentially originate from international tobacco companies.

Zimbabwe wants more indigenous capital to support its tobacco industry. Currently, about 95 percent of farmers work through contract farming arrangements. The Tobacco Industry and Marketing Board hopes local banks will gradually increase their direct financial support for farmers.

Tobacco remains a crucial economic driver for Zimbabwe. The country exported 1.3 billion dollars' worth of tobacco last year. Experts believe Zimbabwe could earn much more money if it invested in processing facilities that create value-added tobacco products instead of just exporting raw leaves.

Most tobacco funding happens through merchants who take big risks lending to farmers. Banks hesitate to loan money directly because farmers lack traditional collateral. Merchants step up as middlemen, providing seeds, fertilizer, and chemical supplies to growers through complex contracting systems.

Analysts suspect some local bank funding might actually come from international sources. Foreign-owned banks like Stanbic and CABS seem to channel money from parent companies overseas. These arrangements make the funding look local but potentially originate from international tobacco companies.

Zimbabwe wants more indigenous capital to support its tobacco industry. Currently, about 95 percent of farmers work through contract farming arrangements. The Tobacco Industry and Marketing Board hopes local banks will gradually increase their direct financial support for farmers.

Tobacco remains a crucial economic driver for Zimbabwe. The country exported 1.3 billion dollars' worth of tobacco last year. Experts believe Zimbabwe could earn much more money if it invested in processing facilities that create value-added tobacco products instead of just exporting raw leaves.