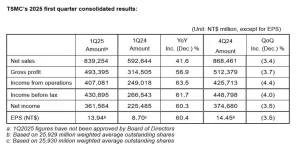

TSMC reported strong quarterly earnings with NT$839.25 billion in revenue for the first quarter of 2025. The chipmaker saw its profits climb to NT$361.56 billion, with earnings per share reaching NT$13.94. These numbers show a major year-over-year boost - revenue up 41.6% and net income jumping 60.3% compared to early 2024. When measured in US dollars, TSMC earned $25.53 billion, growing 35.3% from last year but dipping 5.1% from the previous quarter.

The company maintained impressive profit margins across the board. Their newest chip technology continues to drive business forward. The 3-nanometer chips made up 22% of wafer revenue, with 5-nanometer at 36% and 7-nanometer at 15%. Together, these advanced technologies account for 73% of total wafer sales.

CFO Wendell Huang noted that smartphone seasonal patterns affected business, but AI-related demand helped offset this decline. Looking ahead to the second quarter, TSMC expects revenue between $28.4 and $29.2 billion. The company projects gross profit margins between 57% and 59% and operating margins of 47% and 49%. Despite its strong outlook, TSMC remains cautious about potential tariff impacts on market demand.

The company maintained impressive profit margins across the board. Their newest chip technology continues to drive business forward. The 3-nanometer chips made up 22% of wafer revenue, with 5-nanometer at 36% and 7-nanometer at 15%. Together, these advanced technologies account for 73% of total wafer sales.

CFO Wendell Huang noted that smartphone seasonal patterns affected business, but AI-related demand helped offset this decline. Looking ahead to the second quarter, TSMC expects revenue between $28.4 and $29.2 billion. The company projects gross profit margins between 57% and 59% and operating margins of 47% and 49%. Despite its strong outlook, TSMC remains cautious about potential tariff impacts on market demand.