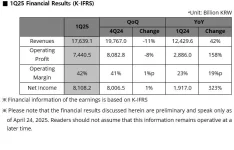

SK hynix earned 17.64 trillion won with an operating profit of 7.44 trillion won during the first quarter. The company posted a net profit of 8.11 trillion won, marking its second-best quarterly results ever. Operating margins grew to 42 percent, continuing eight straight quarters of improvement.

The memory market expanded faster than expected as companies raced to build AI systems and stock up on inventory. SK hynix met this demand with more sales of premium products like 12-layer HBM3E and DDR5 memory. These strong results during a typically slow season show the company has become more competitive than before.

Cash reserves rose slightly to 14.3 trillion won at quarter end compared to late 2024. This helped lower the debt ratio to 29 percent and the net debt ratio to 11 percent. The company plans to work closely with suppliers to satisfy customer needs despite market swings.

As predicted earlier, the HBM market demand should double from last year. Sales of 12-layer HBM3E will likely make up over half of total HBM3E revenue next quarter. The company began shipping LPCAMM2 memory modules for AI PCs last quarter and will start providing SOCAMM2 modules for AI servers when demand increases.

For NAND products, SK hynix will focus on high-capacity enterprise SSDs but maintain careful investment practices. The company aims to improve investment efficiency through smart spending on profitable products with proven demand. As an AI memory leader, SK hynix hopes to keep growing profits through industry-leading technology and partner cooperation.

The memory market expanded faster than expected as companies raced to build AI systems and stock up on inventory. SK hynix met this demand with more sales of premium products like 12-layer HBM3E and DDR5 memory. These strong results during a typically slow season show the company has become more competitive than before.

Cash reserves rose slightly to 14.3 trillion won at quarter end compared to late 2024. This helped lower the debt ratio to 29 percent and the net debt ratio to 11 percent. The company plans to work closely with suppliers to satisfy customer needs despite market swings.

As predicted earlier, the HBM market demand should double from last year. Sales of 12-layer HBM3E will likely make up over half of total HBM3E revenue next quarter. The company began shipping LPCAMM2 memory modules for AI PCs last quarter and will start providing SOCAMM2 modules for AI servers when demand increases.

For NAND products, SK hynix will focus on high-capacity enterprise SSDs but maintain careful investment practices. The company aims to improve investment efficiency through smart spending on profitable products with proven demand. As an AI memory leader, SK hynix hopes to keep growing profits through industry-leading technology and partner cooperation.