Zimbabwe's money troubles eased in December. Prices rose less than banks expected, which marks a win for the nation's push to keep prices steady.

Fresh numbers from Zimbabwe tell a good story. The country tracks prices in two ways - with its own money, the ZiG, and with U.S. dollars. Both showed better signs last month.

ZiG prices increased just 3.7 percent in December, much lower than the 11.7 percent rise in November. Food costs also climbed less, and other things cost less.

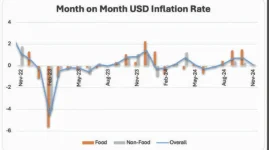

The U.S. dollar side stayed calm. Prices in dollars went up by less than one percent, which helped people who used both kinds of money to buy things.

Bank leaders had hoped to keep price rises under 5 percent. Thanks to strict rules about spending and lending money, they hit this mark. The International Money Fund thought prices might go up by 7 percent. Zimbabwe did better than that.

Food prices are an important part of this story. They jumped less in December than in previous months, which helps regular people buy what they need each day.

When you mix both money types, prices rose just 1.1 percent. That's half of what they rose in November. It shows Zimbabwe's money plans might work.

Yet some experts see risks ahead. Having two types of money makes things tricky. Leaders must watch both the ZiG and the dollar closely.

The next year brings new tests. Zimbabwe must keep these good trends going. If it does, people might trust their money more. That could help everyone buy what they need without paying too much.

These better numbers give hope. They show that Zimbabwe can control its prices. However, the country must keep working hard to ensure that prices stay steady in 2025.

Fresh numbers from Zimbabwe tell a good story. The country tracks prices in two ways - with its own money, the ZiG, and with U.S. dollars. Both showed better signs last month.

ZiG prices increased just 3.7 percent in December, much lower than the 11.7 percent rise in November. Food costs also climbed less, and other things cost less.

The U.S. dollar side stayed calm. Prices in dollars went up by less than one percent, which helped people who used both kinds of money to buy things.

Bank leaders had hoped to keep price rises under 5 percent. Thanks to strict rules about spending and lending money, they hit this mark. The International Money Fund thought prices might go up by 7 percent. Zimbabwe did better than that.

Food prices are an important part of this story. They jumped less in December than in previous months, which helps regular people buy what they need each day.

When you mix both money types, prices rose just 1.1 percent. That's half of what they rose in November. It shows Zimbabwe's money plans might work.

Yet some experts see risks ahead. Having two types of money makes things tricky. Leaders must watch both the ZiG and the dollar closely.

The next year brings new tests. Zimbabwe must keep these good trends going. If it does, people might trust their money more. That could help everyone buy what they need without paying too much.

These better numbers give hope. They show that Zimbabwe can control its prices. However, the country must keep working hard to ensure that prices stay steady in 2025.